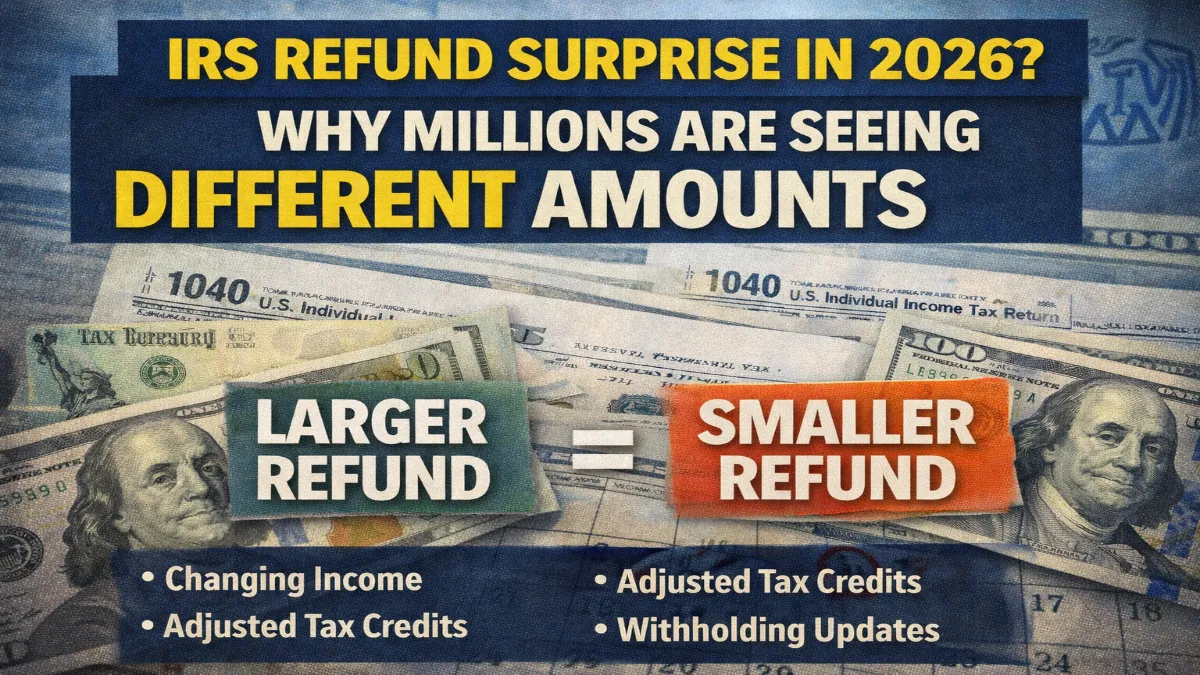

As the 2026 tax season unfolds, many Americans are noticing something unexpected: their IRS refund amounts look very different from last year. Some taxpayers are receiving larger refunds, while others are surprised to see smaller deposits—or none at all. This shift is raising questions nationwide about what changed and why refund amounts vary so widely in 2026.

The answer lies in income changes, tax credit adjustments, and how much was withheld during the year.

Income Changes Are Playing a Big Role

One of the biggest reasons for refund differences in 2026 is income fluctuation. Many workers saw raises, bonuses, or job changes in 2025. While higher income is usually good news, it can reduce refunds if tax withholding did not increase accordingly.

On the other hand, taxpayers who earned less or worked fewer months may qualify for larger refunds due to lower tax liability.

Tax Credits Are Affecting Refund Totals

Refundable tax credits continue to strongly influence refund amounts. Families claiming credits related to dependents or income-based benefits may see higher refunds, especially if their income falls within qualifying ranges.

However, even small income increases can push taxpayers out of full eligibility, reducing the credit amount and lowering the final refund. This explains why neighbors or coworkers with similar jobs may see very different refund results.

Withholding Choices Matter More Than Ever

Many Americans updated their paycheck withholding in recent years, often without realizing the long-term effect. If less tax was withheld throughout the year, refunds in 2026 may be smaller because more money was already received in paychecks.

In contrast, taxpayers who over-withheld may now see larger refunds. This difference often feels like a surprise, even though the total tax paid balances out.

Filing Status and Life Changes Impact Refunds

Major life events can significantly affect refund amounts. Marriage, divorce, having a child, or becoming a dependent on someone else’s return can all change how taxes are calculated.

Some taxpayers filing under a new status in 2026 are discovering that these changes directly impact their refund, sometimes in unexpected ways.

Why Early Filers Are Seeing Faster Results

Many early filers are not only receiving refunds faster but also noticing clearer refund calculations. Filing early reduces processing delays and lowers the chance of IRS reviews, which can temporarily hold refunds.

Those who filed electronically and chose direct deposit are often the first to see their refund amounts finalized.

What Taxpayers Should Do Moving Forward

If your 2026 refund looks different than expected, reviewing your withholding settings is a smart next step. Adjusting withholding now can help avoid surprises in future tax seasons.

Understanding how income, credits, and filing choices work together makes tax outcomes more predictable and less stressful.

What This Means for the Rest of the Tax Season

Refund differences in 2026 are not a sign of IRS errors in most cases. Instead, they reflect changing financial situations and updated tax calculations. While refund amounts vary, accurate filing and early preparation remain the best way to stay in control.

For millions of Americans, the 2026 tax season is a reminder that refunds are personal—and no two returns are exactly the same.